The United States economy demonstrated continued price stability in December, with the annual inflation rate holding firm at 2.7 percent, a figure that suggests a sustained period of moderate price increases. This consistent reading offers a degree of predictability for consumers and businesses alike, while economists scrutinize the underlying drivers and potential future trajectory of this economic indicator.

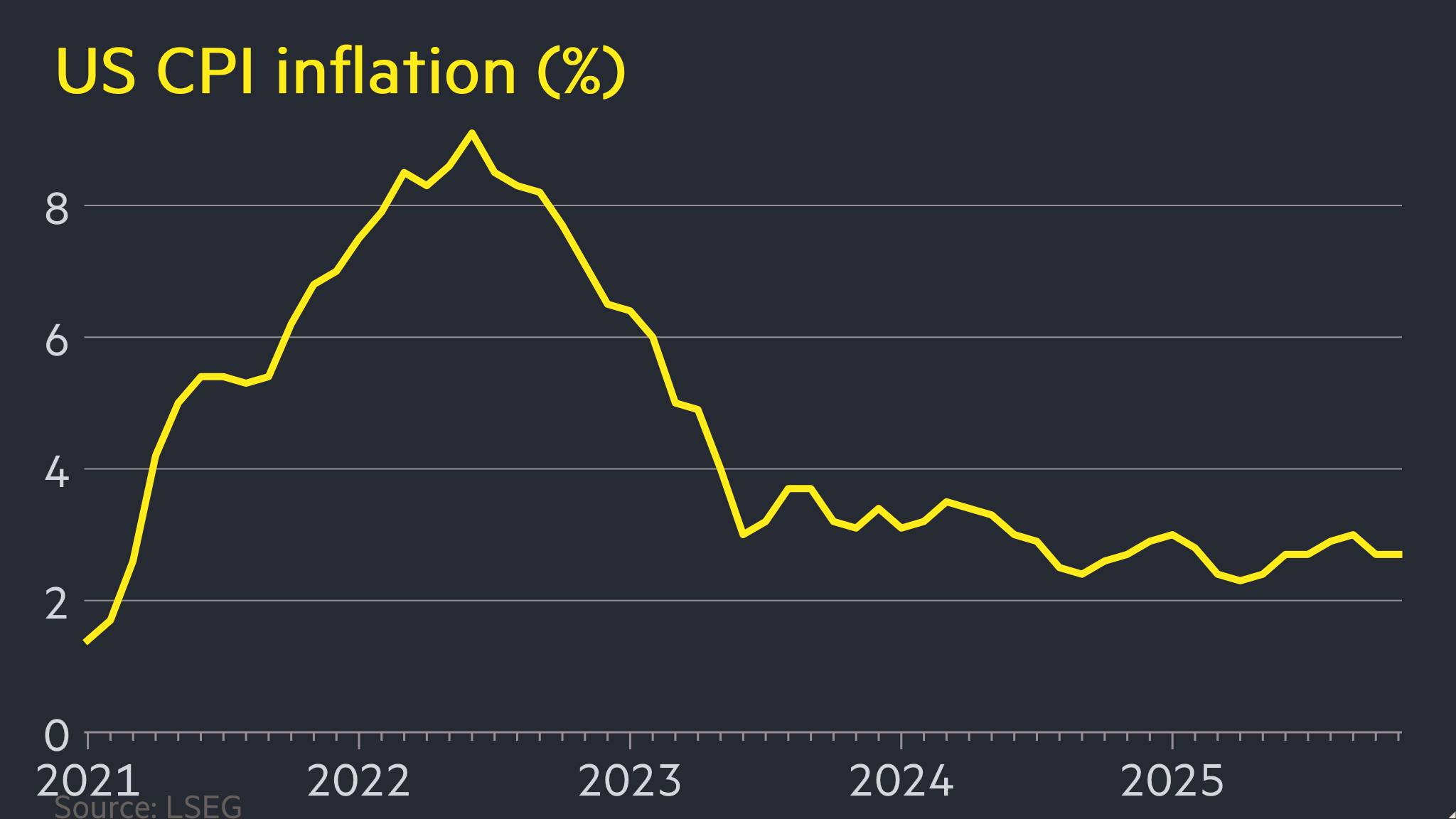

The December inflation data, as measured by the Consumer Price Index (CPI), reflects a delicate balance within the American economy. While a 2.7 percent annual increase is notably above the Federal Reserve’s long-term target of 2 percent, it represents a stabilization rather than an acceleration of price pressures. This steadiness is a significant development, particularly following a period of heightened inflation that began in 2021. The persistence of this rate indicates that the inflationary forces that dominated recent years may be losing some of their momentum, or at least have settled into a new, albeit elevated, equilibrium.

Understanding the components of this 2.7 percent figure is crucial for a comprehensive economic assessment. While the headline number provides a broad overview, the performance of specific sectors offers a more granular insight into inflationary trends. Energy prices, often a volatile component of the CPI, likely played a role, though their precise impact would depend on month-over-month fluctuations. Similarly, food costs, another significant category for household budgets, would contribute to the overall picture. The core inflation rate, which excludes the more volatile food and energy sectors, is often watched closely by policymakers as it provides a clearer view of underlying price pressures. If core inflation has also remained stable, it would further bolster the narrative of sustained moderation.

The Federal Reserve’s monetary policy stance is intrinsically linked to inflation data. For much of the past two years, the central bank has engaged in aggressive interest rate hikes to combat soaring inflation. The current stable inflation rate of 2.7 percent presents a complex challenge for policymakers. On one hand, it suggests that their tightening measures may be having the desired effect of cooling demand and bringing prices under control. On the other hand, the rate remains above their target, indicating that further action might still be warranted, or at least that a premature relaxation of policy could reignite inflationary pressures. The decision-making process will likely involve a careful weighing of current data against future economic projections, considering the lagged effects of past policy decisions.

Several macroeconomic factors could be contributing to this sustained inflation rate. Supply chain disruptions, which were a major catalyst for earlier price surges, may have eased to some extent, allowing for a more normalized flow of goods and services. Shifts in consumer demand, potentially influenced by economic uncertainty or a recalcitrant savings rate, could also be playing a role in tempering price increases. Furthermore, the labor market, while remaining robust, may be experiencing a moderation in wage growth, which can be a significant driver of inflation. A cooling labor market, characterized by fewer job openings and a more balanced supply of workers, would typically translate into less upward pressure on wages and, consequently, on prices.

The implications of a 2.7 percent inflation rate are far-reaching. For consumers, it means that while the sharp erosion of purchasing power seen in previous years may have subsided, the cost of living continues to rise at a pace that outstrips wage growth for many. This can lead to a gradual decline in real incomes and necessitate adjustments in household spending patterns. For businesses, stable, albeit elevated, inflation presents both opportunities and challenges. While it can provide some pricing power, it also increases input costs and can create uncertainty around future profitability. Businesses will need to carefully manage their pricing strategies and operational efficiencies to navigate this environment.

From an investment perspective, sustained inflation influences asset allocation and market dynamics. Fixed-income assets, such as bonds, are particularly sensitive to inflation, as it erodes the real return on investment. Investors may seek assets that offer a hedge against inflation, such as commodities or real estate, or focus on equities of companies with strong pricing power. The Federal Reserve’s continued policy decisions, informed by inflation data, will also be a key determinant of market performance.

Looking ahead, the trajectory of US inflation remains a subject of considerable debate among economists. Several factors could influence future price movements. Geopolitical events, such as conflicts or trade disputes, can trigger supply shocks and impact energy and commodity prices. The evolution of the global economy, including the pace of recovery in other major economies, could also influence demand for US goods and services. Domestically, the effectiveness of ongoing monetary policy, the resilience of consumer spending, and the dynamics of the labor market will all be critical determinants.

The possibility of inflation re-accelerating, while perhaps less likely than a year ago, cannot be entirely dismissed. Any significant disruption to energy markets or a renewed surge in consumer demand could push prices higher. Conversely, a more pronounced slowdown in economic activity or a further easing of supply chain pressures could lead to a moderation in inflation. The Federal Reserve will likely maintain a data-dependent approach, closely monitoring incoming economic statistics and adjusting its policy as necessary to achieve its dual mandate of price stability and maximum employment.

The current inflation rate of 2.7 percent, while a positive sign of moderation compared to recent peaks, highlights the ongoing challenge of returning inflation to the Federal Reserve’s target. It signifies an economy that has moved past the acute inflationary pressures of the immediate post-pandemic period but has not yet fully returned to the pre-pandemic norm of price stability. The sustained nature of this rate suggests that structural factors and policy responses are working in tandem, creating a new baseline for price increases.

The analysis of this persistent 2.7 percent inflation rate necessitates a multi-faceted approach, considering not only the headline number but also its underlying drivers and the broader economic context. The Federal Reserve’s careful navigation of this economic landscape will be critical in shaping the future of the US economy, balancing the need to control inflation with the imperative to foster sustainable economic growth and maintain employment. The coming months will undoubtedly provide further clarity on whether this period of stability represents a sustained return to normalcy or a temporary pause before further price adjustments.