In the immediate aftermath of a significant geopolitical event involving the apprehension of Venezuelan President Nicolás Maduro by United States forces, a striking pattern of highly profitable speculation has emerged on a prominent prediction market platform. An anonymous user, operating under a recently established account, placed a series of substantial wagers just prior to the military action, ultimately realizing an extraordinary profit exceeding several hundred thousand dollars from an initial investment in the tens of thousands.

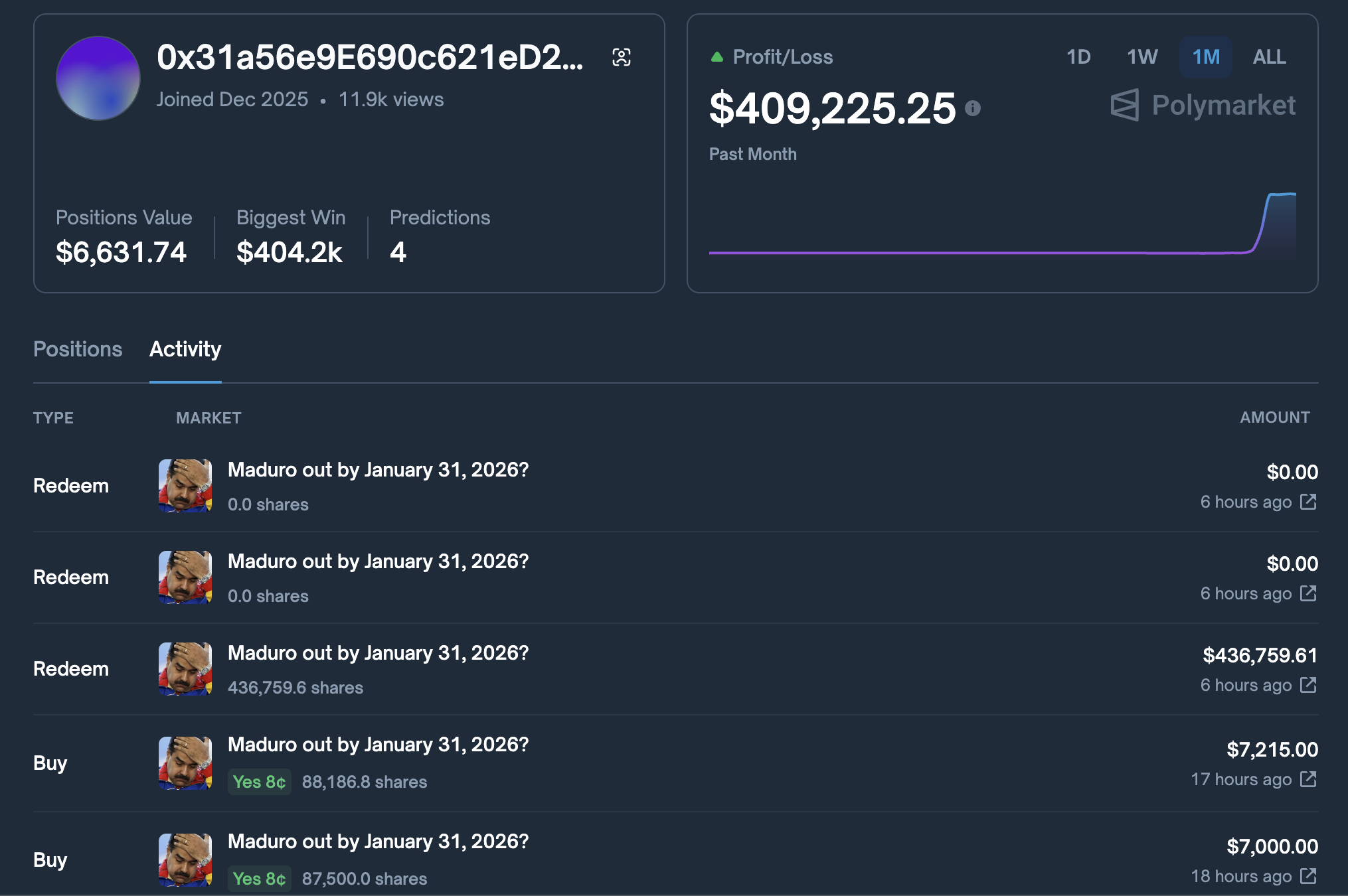

The events surrounding the capture of President Nicolás Maduro by United States military forces have been accompanied by an extraordinary display of market foresight, or perhaps something more. On Polymarket, a digital platform that facilitates predictions on future events, a user operating under the pseudonym "0x31a56e9E690c621eD21De08Cb559e9524Cdb8eD9" executed a series of highly lucrative trades in the days leading up to and immediately following the operation. This individual, whose account was created less than a week before the pivotal events, strategically invested over $30,000 in the market designed to predict the removal of President Maduro from power. The timing and magnitude of these investments have drawn significant attention, particularly as the "out by January 31, 2026" contract, which had been trading at a meager $0.07 just hours before the military action, saw its value skyrocket. Within a 24-hour window following the news of Maduro’s capture, this user’s investment transformed into a staggering profit of over $408,000, representing an astronomical return on investment.

This remarkable financial outcome has ignited a robust discussion across social media platforms and within financial analysis circles. Observers have pointed to the uncanny precision of the trades, leading to widespread speculation that the individual may have possessed non-public information. The proximity of the account’s creation to the successful operation, coupled with the substantial financial gains, has fueled theories suggesting potential links to governmental or intelligence agencies, specifically within the Pentagon. The nature of prediction markets, which inherently allow for speculative trading on a wide array of outcomes, including political and geopolitical events, has been brought into sharp focus.

The phenomenon of alleged insider trading on prediction markets is not unprecedented. Numerous instances have been documented where individuals appear to profit handsomely from events that were either imminent or had already occurred but had not yet been publicly disclosed. These platforms, by their very design, can become fertile ground for such activities if robust oversight and transparency mechanisms are not rigorously implemented. The core value proposition of these markets, as articulated by some operators, is not necessarily the creation of a perfectly level playing field for all participants, but rather their function as sophisticated, real-time news aggregators and sentiment indicators. In this paradigm, the ability to profit from privileged information, while ethically dubious, is seen by some as an inherent, albeit undesirable, byproduct of the market’s information-gathering capabilities.

Platforms like Polymarket and Kalshi operate in a regulatory gray area. While they facilitate bets on a multitude of future events, their classification as exchanges, gambling platforms, or information services can vary depending on jurisdiction and regulatory scrutiny. The question of how to police insider trading on these platforms is complex. Unlike traditional financial markets, which are subject to stringent regulations and enforcement by bodies like the Securities and Exchange Commission (SEC) in the United States, prediction markets often operate with less direct oversight. This lack of comprehensive regulation can create an environment where the potential for exploitation by those with access to non-public information is amplified.

Kalshi, another prominent prediction market, has publicly stated that such activity is contrary to their operational guidelines. In a statement shared on X (formerly Twitter), the company reiterated its commitment to fair play and adherence to its terms of service, which prohibit the exploitation of material non-public information. However, the practical enforcement of these rules, especially when dealing with anonymous or pseudonymous users operating across decentralized platforms, presents significant challenges. The very nature of blockchain-based prediction markets, which can offer a degree of anonymity and decentralization, further complicates efforts to trace and penalize illicit trading activities.

The situation underscores a broader debate about the role and regulation of prediction markets. Proponents argue that these platforms offer valuable insights into public sentiment and can serve as accurate forecasting tools. They can aggregate dispersed knowledge and reveal consensus views on future events, acting as a form of distributed intelligence. However, critics highlight the inherent risks associated with their use, particularly the potential for manipulation and insider trading, which can undermine the integrity of the market and lead to unfair outcomes for legitimate participants. The recent events surrounding the Venezuelan president’s capture serve as a stark reminder of these vulnerabilities.

The implications of this incident extend beyond the financial realm. The effective dissemination of information, or misinformation, related to sensitive geopolitical operations can have profound consequences. If individuals can reliably profit from foreknowledge of such events, it raises questions about the security of information and the potential for market manipulation to influence public perception or even strategic decision-making. The ability of a single account to amass such substantial profits with apparent foreknowledge suggests a potential failure in information security protocols or, at the very least, a significant arbitrage opportunity that was exploited with remarkable efficiency.

Looking forward, the incident is likely to prompt increased scrutiny of prediction market operations by regulators and financial authorities. The ease with which substantial profits were realized by a new account, coinciding precisely with a major international event, demands a thorough investigation into the platform’s security and compliance measures. The decentralized nature of some of these markets poses a unique challenge, as traditional enforcement mechanisms may not be fully applicable. This could lead to calls for greater transparency in user identification, more robust auditing of trades, and clearer legal frameworks governing the operation of prediction markets, particularly when they involve events with significant geopolitical or economic implications.

The future of prediction markets will likely be shaped by the ongoing tension between their utility as forecasting tools and their susceptibility to illicit practices. As these platforms become more sophisticated and integrated into the broader digital economy, the imperative to establish and enforce clear ethical and regulatory guidelines will only grow. The significant financial windfall realized in the wake of the Venezuelan leadership change serves as a potent case study, highlighting the urgent need for a comprehensive approach to ensuring the integrity and fairness of these evolving speculative environments. The question remains whether platforms can self-regulate effectively or if external intervention will be necessary to prevent the exploitation of insider information and to foster trust in the predictive capabilities of these novel markets. The long-term viability and public acceptance of prediction markets hinge on their ability to demonstrate a commitment to transparency and a proactive stance against manipulative practices.