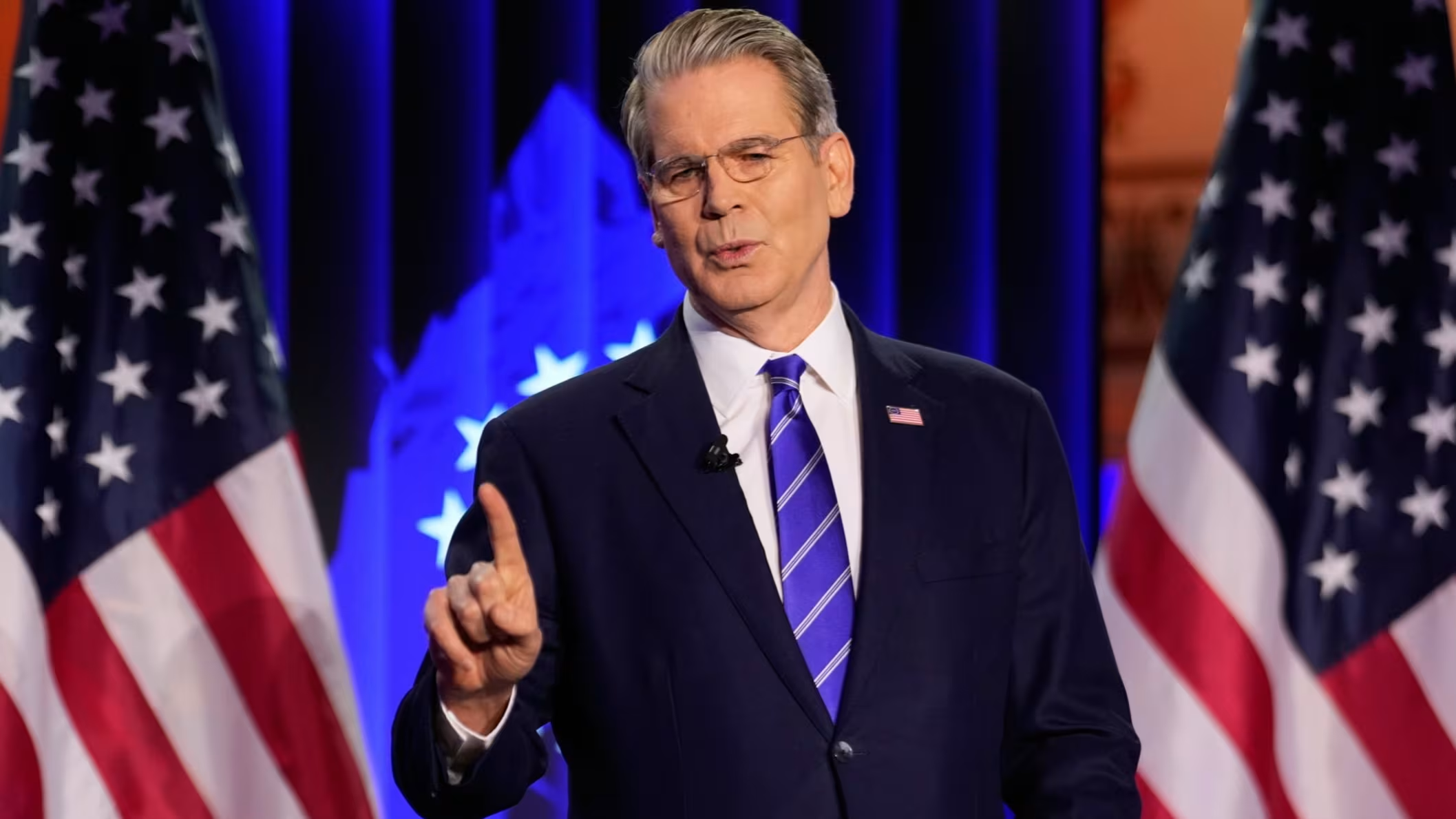

Scott Bessent, the chief investment strategist at Deutsche Bank, has indicated a significant decoupling between the bank’s official research output concerning U.S. assets and the institution’s broader strategic positioning. This divergence suggests a deliberate effort by senior leadership to distance the bank from a particular research note that presented a cautionary outlook on the American economic landscape and its financial markets. The implications of this strategic recalibration are far-reaching, potentially impacting investor confidence, internal research integrity, and the bank’s advisory services.

This development emerges at a critical juncture for global financial markets, where the economic trajectory of the United States holds immense sway. Bessent’s remarks, made in a context that underscores the influence of high-level strategy on research dissemination, point towards a deliberate editorial decision by Deutsche Bank’s leadership. The specific research note in question appears to have offered a bearish perspective on U.S. assets, a view that may have been deemed misaligned with the bank’s overarching strategic objectives or its desired market narrative. The act of distancing the bank from such research signals a sophisticated approach to managing market perception and internal intellectual capital.

The Nuance of Strategic Alignment in Financial Research

The financial services industry, particularly at the institutional level, operates under a complex interplay of research, strategy, and client advisory. Research departments are tasked with providing objective, data-driven analysis to inform investment decisions. However, the interpretation and presentation of this research can be influenced by the broader strategic imperatives of the institution. In this instance, Scott Bessent’s statement suggests that Deutsche Bank’s leadership has opted to draw a clear line between a specific piece of research and the bank’s established strategic direction. This is not an uncommon practice, as institutions often aim to present a cohesive and positive outlook to their clients and the market, especially when dealing with complex and volatile asset classes like U.S. equities and bonds.

The underlying rationale for such a strategic dissociation can be multifaceted. Firstly, a particularly negative research outlook, if not accompanied by a clear strategic counterpoint or risk mitigation strategy, could be perceived as overly alarmist or even detrimental to client relationships. Banks often aim to guide their clients through market fluctuations rather than simply predicting downturns. Secondly, the bank might have a vested interest in maintaining investor confidence in key markets where it operates and has significant exposure. A widely disseminated negative research report could undermine this confidence. Thirdly, internal strategic alignment ensures that different departments within the bank are not working at cross-purposes. If the bank’s trading desks or asset management divisions are actively engaged in strategies that benefit from a stable or growing U.S. market, a research note that predicts a severe downturn would create an internal contradiction.

Dissecting the "Research Note on U.S. Assets"

While the precise contents of the research note remain undisclosed, its focus on "U.S. assets" suggests a broad scope, potentially encompassing equities, bonds, real estate, and other financial instruments deeply intertwined with the American economy. A bearish stance on these assets could stem from various concerns, including:

- Inflationary Pressures and Interest Rate Hikes: Persistent inflation and aggressive monetary policy tightening by the Federal Reserve can lead to higher borrowing costs, reduced corporate profitability, and a dampening effect on asset valuations.

- Economic Slowdown or Recession Fears: Indicators such as declining consumer spending, weakening manufacturing data, or a flattening yield curve might signal an impending economic contraction, which typically correlates with declining asset prices.

- Geopolitical Risks: International tensions, trade disputes, or global instability can create uncertainty and volatility in financial markets, particularly impacting a globally integrated economy like the U.S.

- Valuation Concerns: If U.S. assets are perceived to be overvalued relative to historical norms or earnings potential, a research note might recommend caution.

- Structural Economic Challenges: Long-term issues such as rising national debt, demographic shifts, or technological disruption could also form the basis of a negative outlook.

The fact that Deutsche Bank’s chief strategist felt compelled to publicly distance the bank from this specific research suggests that the note’s conclusions were either exceptionally strong, potentially inaccurate in the bank’s view, or strategically inconvenient. This implies a level of confidence within the bank’s leadership that the U.S. economic outlook, despite potential headwinds, is not as dire as portrayed in that particular report, or that the bank is strategically positioned to navigate such challenges effectively.

Implications for Investor Confidence and Market Perception

When a prominent financial institution like Deutsche Bank distances itself from its own research, it sends a nuanced signal to the market. On one hand, it demonstrates a commitment to strategic coherence and a proactive approach to managing its public image and client advisement. It suggests that the bank is not simply a passive conduit for research but an active participant in shaping its market narrative.

However, such actions can also introduce a degree of skepticism. Investors and analysts often rely on the perceived objectivity of research. If a research note is publicly disavowed or downplayed, it can lead to questions about the internal research process, the criteria for publication, and the potential for undue influence from senior management or business interests. This could potentially erode trust in the institution’s research capabilities.

For clients of Deutsche Bank, this development necessitates a more discerning approach. They may need to understand not only the content of the research but also the strategic context in which it is presented. This could involve seeking clarification from relationship managers about the bank’s definitive stance on U.S. assets and how the differing viewpoints are reconciled within the bank’s advisory framework.

The Role of the Chief Investment Strategist

The role of a Chief Investment Strategist (CIS) is pivotal in bridging the gap between economic analysis and actionable investment strategy. Scott Bessent, in this capacity, is responsible for articulating the firm’s overarching investment themes and outlook. His statements carry significant weight, as they are typically derived from a high-level synthesis of market intelligence, economic forecasts, and the firm’s strategic priorities.

When a CIS addresses a divergence between research and strategy, it highlights the complex decision-making processes within large financial organizations. It implies that not all research findings are treated with equal strategic weight, and that the ultimate message conveyed to the market is a curated one. This curation is often designed to align with the firm’s business objectives, risk appetite, and client base. Bessent’s intervention suggests that the research note in question may have presented a view that was either too extreme, potentially damaging to client relationships, or not in line with the bank’s forward-looking strategy.

Broader Implications for the Financial Industry

The situation at Deutsche Bank is emblematic of broader trends in the financial industry regarding the production and dissemination of research. In an era of instant information and intense market scrutiny, institutions are increasingly aware of the power of narrative and perception. This leads to a more sophisticated approach to managing research output, where strategic alignment is often prioritized.

This can manifest in several ways:

- "House Views" and Strategic Research: Many institutions develop and promote a "house view" – a consolidated outlook that represents the firm’s official stance. This house view often incorporates insights from various research teams but is ultimately shaped by senior leadership and strategic considerations.

- Internal Review Processes: Research reports, especially those with significant market implications, often undergo rigorous internal review processes involving not just the research analysts but also strategists, risk managers, and business heads.

- Client-Centric Research Presentation: The way research is presented to clients is also carefully managed. Analysts may be encouraged to frame their findings within the context of the bank’s broader strategic recommendations and risk management frameworks.

While this strategic management of research can provide clarity and a unified message, it also raises questions about intellectual diversity and the unfettered exploration of dissenting viewpoints within financial institutions. The challenge lies in balancing the need for strategic coherence with the imperative to foster an environment where rigorous, independent research can flourish.

Future Outlook and Potential Scenarios

The strategic distancing from the U.S. asset research note by Deutsche Bank sets the stage for several potential future developments:

- Refined Research Methodologies: The bank might reassess its research methodologies to ensure that future analyses are more closely aligned with its strategic objectives, or that potential divergences are identified and addressed earlier in the research process.

- Enhanced Communication Strategies: Deutsche Bank may implement more sophisticated communication strategies to clearly delineate between speculative research, thematic analyses, and the bank’s definitive strategic outlook. This could involve tiered research publications or explicit disclaimers.

- Increased Scrutiny of Research Integrity: The market and industry observers will likely pay closer attention to Deutsche Bank’s research output and strategic communications. Any perceived inconsistencies could lead to further questioning of the bank’s analytical rigor.

- Client Adaptability: Clients will need to adapt to this nuanced approach, potentially seeking independent validation of research or engaging in deeper dialogue with their Deutsche Bank contacts to understand the bank’s core strategic positioning.

In conclusion, Scott Bessent’s remarks signify a deliberate strategic maneuver by Deutsche Bank to manage its market narrative and ensure that its official research output aligns with its broader institutional objectives. This incident underscores the intricate relationship between research, strategy, and market communication within leading financial institutions, highlighting the ongoing evolution of how financial insights are produced, interpreted, and deployed in the complex global marketplace. The implications extend beyond this single research note, offering a window into the sophisticated decision-making processes that shape institutional investment strategies.