The burgeoning demand for high-bandwidth memory, particularly driven by the artificial intelligence revolution, has precipitated another wave of price increases for DDR5 RAM modules, impacting consumer technology manufacturers like Framework. The modular PC company has announced a further adjustment to its DDR5 memory pricing, a move that reflects broader industry trends and signals ongoing volatility in the global memory market. This latest revision underscores the profound impact of supply chain dynamics and the strategic resource allocation by major memory manufacturers on the accessibility and cost of essential computing components.

The persistent upward trajectory of memory costs is a complex phenomenon rooted in a confluence of factors. At its core lies the insatiable appetite for advanced computing power, largely fueled by the rapid expansion of artificial intelligence (AI) workloads. AI models, from large language models to sophisticated image recognition systems, demand exponentially larger datasets and more intricate computational processes, which in turn necessitate significant increases in memory capacity and speed. This surge in demand, particularly for high-performance DDR5 modules, has created a substantial imbalance between supply and demand, pushing prices to unprecedented levels.

Framework, a company built on the principles of repairability and modularity, is particularly sensitive to these market fluctuations. Their commitment to offering users choice and customization through their DIY Edition laptops means they are directly exposed to the fluctuating costs of individual components. The company’s recent announcement details a renewed price adjustment for its DDR5 RAM offerings, citing ongoing "substantially higher costs" from its suppliers and distributors. This is not an isolated incident; earlier in the month, Framework had already implemented a price increase, and this latest revision indicates that the pressure on their supply chain has not abated.

The specific increases highlight the severity of the situation. For instance, the 8GB DDR5 module has seen its price climb from an initial $60 to $80, a significant jump for a foundational component. Similarly, the 16GB variant has risen from $120 to $160, and the 32GB option from $240 to $320. Perhaps most striking is the escalation in pricing for higher-capacity modules. The 48GB option has more than doubled in price, moving from $240 to a substantial $620. The 64GB and 96GB configurations have also seen considerable price hikes, now retailing at $640 and $1,240, respectively. These figures represent not just incremental adjustments but a fundamental shift in the cost structure of these essential memory components.

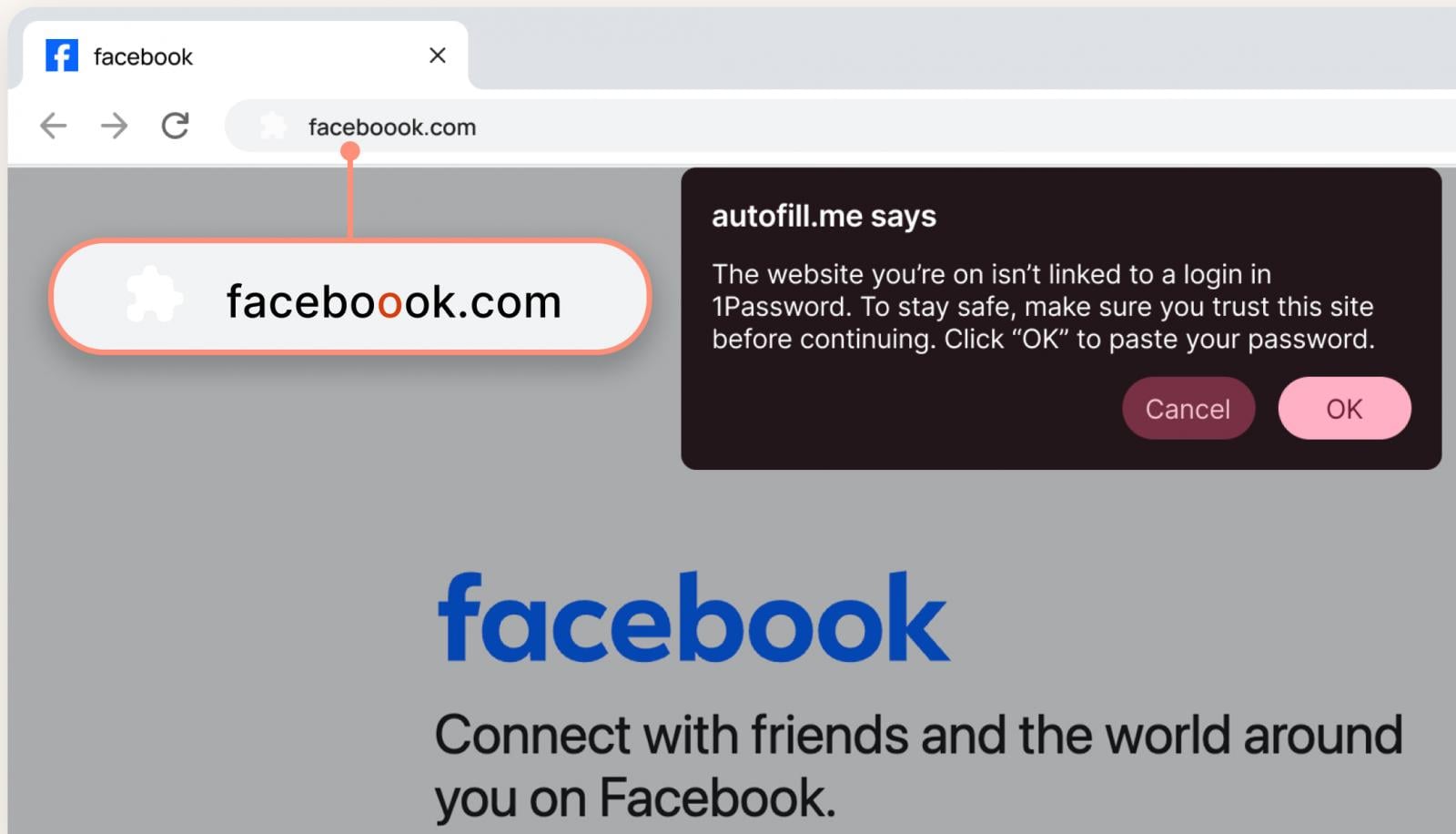

Framework’s strategy in response to this volatile market is multifaceted. Recognizing the impact on its DIY Edition laptops, the company is currently not offering standalone DDR5 RAM modules. This decision is a pragmatic measure aimed at preserving its inventory of this high-demand component and ensuring that its core product remains accessible, albeit with adjusted pricing. For consumers looking to mitigate the increased cost, Framework offers a crucial workaround: the option to purchase the DIY Edition laptop without pre-installed memory. This allows users to leverage existing RAM modules from previous systems or to source memory independently. To further assist consumers in finding competitive pricing, Framework has integrated a direct link to PCPartPicker on its website, a valuable resource for comparing component prices and compatibility across various retailers.

The underlying cause of these escalating prices is deeply rooted in the global semiconductor supply chain and the strategic decisions of major memory manufacturers. Companies like Micron, Samsung, and SK Hynix, the dominant players in the memory market, are currently redirecting a significant portion of their resources and manufacturing capacity towards the burgeoning artificial intelligence sector. The insatiable demand for high-performance memory in AI training and inference applications has created a lucrative market, prompting these manufacturers to prioritize production for AI-centric hardware. This strategic pivot, while understandable from a business perspective, has inevitably led to a constrained supply of memory modules for the broader consumer and enterprise markets, including those used in general-purpose computing devices and laptops.

Industry analysts and market research firms corroborate this outlook. The International Data Corporation (IDC) has projected that the global memory shortage is likely to persist well into 2027. This long-term forecast underscores the structural nature of the current supply-demand imbalance and suggests that consumers and businesses alike should brace for continued price volatility in the memory market for the foreseeable future. The sustained reallocation of manufacturing resources towards AI-specific memory solutions, coupled with the inherent complexities and lead times in semiconductor production, points towards a prolonged period of elevated prices.

Framework’s transparency about the situation is commendable. The company has explicitly stated that further price adjustments are highly probable in the near term. Suppliers are indicating that prices are expected to continue their ascent into early 2026. Framework acknowledges that they have absorbed some of these cost increases to cushion the impact on their customers, but the economic reality necessitates further adjustments. Their commitment, however, remains to pass on only the direct increases in costs and to reduce prices proportionally as market conditions improve and component costs decline. This approach, while challenging for consumers in the short term, aligns with Framework’s ethos of fair pricing and long-term sustainability.

The implications of this persistent memory price hike extend beyond the immediate cost for consumers. For the broader technology ecosystem, it signifies a critical juncture. The cost of computing power is directly tied to the price of its fundamental components. As memory becomes more expensive, it could potentially slow down the adoption of new technologies that rely heavily on memory capacity, or it could force a re-evaluation of hardware design and optimization strategies. The push for more efficient memory utilization and the exploration of alternative memory technologies may gain further traction as a response to these economic pressures.

Furthermore, the concentration of memory manufacturing in the hands of a few major players, coupled with the strategic shift towards AI, raises questions about market resilience and diversification. While the AI boom is undeniably transformative, an over-reliance on a single market segment for a foundational technology like memory could create vulnerabilities in the wider technology landscape. Efforts to foster greater diversity in memory production and to ensure a stable supply for all market segments will be crucial in navigating this evolving industry.

In conclusion, Framework’s latest price adjustment for DDR5 RAM is a stark indicator of the pervasive challenges within the global memory market. Driven by the unprecedented demand from the AI sector and strategic resource allocation by key manufacturers, the cost of memory is on an upward trajectory that shows no immediate signs of reversal. While Framework’s commitment to transparency and user empowerment through configuration options offers some relief, the broader industry faces a sustained period of price volatility. The long-term outlook suggests that innovation in memory technology and strategic supply chain management will be paramount in addressing these ongoing market dynamics and ensuring the continued accessibility of essential computing components.