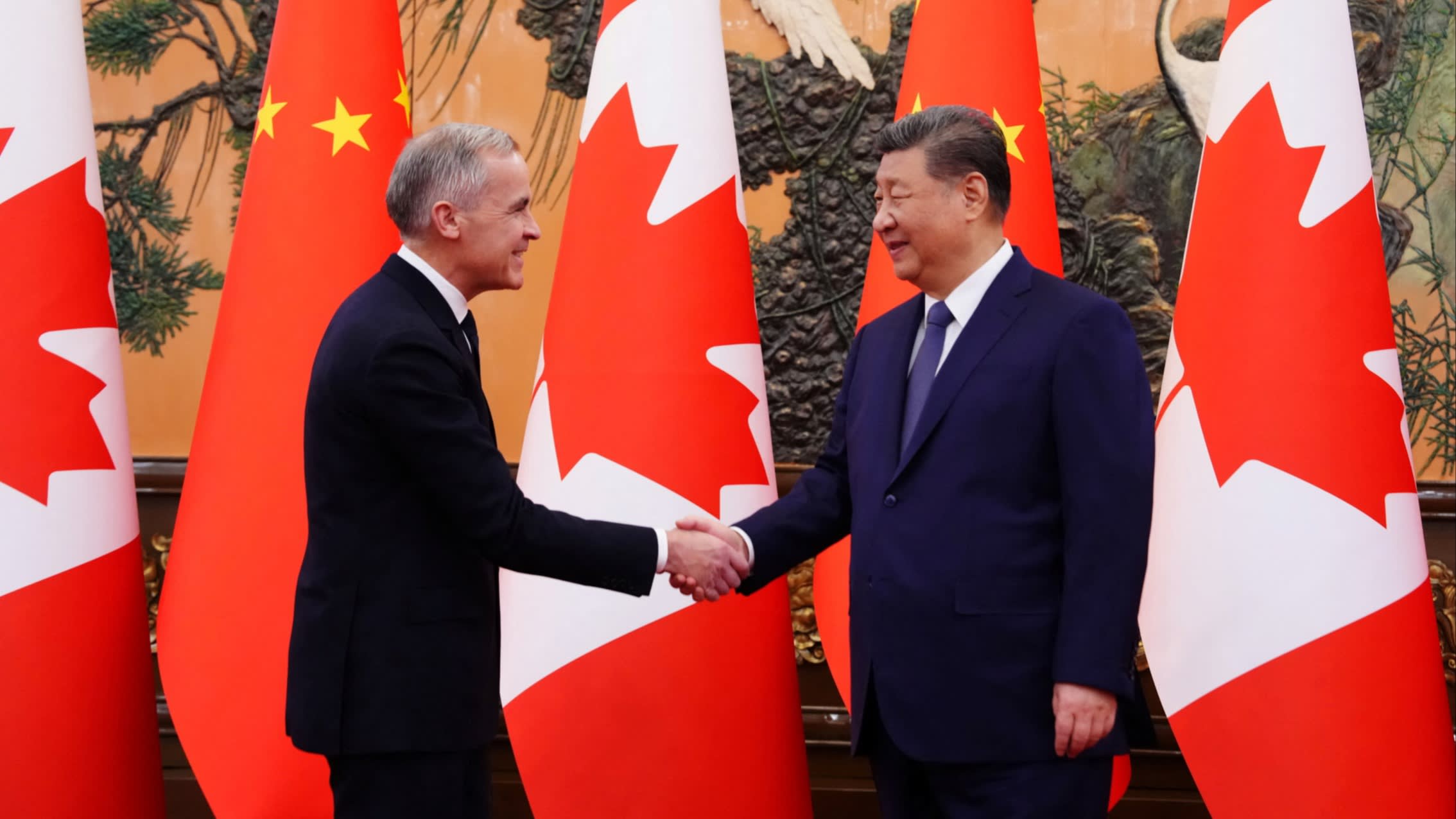

In a significant diplomatic engagement, Mark Carney, former Governor of the Bank of England and Bank of Canada, met with Chinese President Xi Jinping, signaling a concerted effort to reinforce bilateral economic and financial ties at a time of increasing geopolitical fragmentation and uncertainty. This high-level dialogue occurs against a backdrop of escalating trade tensions and a reordering of international relations, largely influenced by the disruptive foreign policy approaches emanating from the United States under the Trump administration. The meeting underscores a mutual recognition of the need for stability and predictability in the global economic architecture, even as traditional alliances are tested and new power dynamics emerge.

The global economic landscape is undergoing a profound transformation, characterized by a discernible shift away from multilateralism towards more nationalistic and protectionist agendas. This paradigm shift, accelerated by the policies and rhetoric of the former US administration, has created a ripple effect across international markets and diplomatic corridors. Nations are reassessing their economic partnerships, seeking to safeguard their interests in an environment marked by unpredictability and a potential rollback of established trade agreements. Within this complex and evolving milieu, the engagement between Carney and Xi Jinping represents a crucial attempt to inject a degree of stability into the vital Sino-Canadian economic relationship.

Mark Carney, in his capacity as a prominent figure in international finance and a former central banker, brings a wealth of experience and a deep understanding of global economic mechanisms to this dialogue. His tenure at the helm of two of the world’s major central banks has equipped him with a nuanced perspective on the interconnectedness of national economies and the imperative of international cooperation. His participation in discussions with President Xi Jinping suggests a deliberate effort to engage China on issues of mutual economic interest, potentially encompassing trade, investment, climate finance, and the broader architecture of global financial governance.

President Xi Jinping, as the paramount leader of China, presides over an economy that has become inextricably woven into the fabric of global commerce. China’s economic ascent has redefined international trade patterns, supply chains, and investment flows. Recognizing the potential for economic disruption stemming from unilateral actions and trade disputes, Beijing has also signaled a desire for greater predictability and stability in its international economic engagements. The meeting with Carney, therefore, provides a platform for China to articulate its economic vision and to explore avenues for continued collaboration with key global economic players.

The timing of this high-level meeting is particularly salient. The previous US administration pursued a foreign policy characterized by a transactional approach, often prioritizing bilateral deals over established multilateral frameworks. This strategy led to the imposition of tariffs, the renegotiation of trade pacts, and a general atmosphere of uncertainty that impacted global markets and diplomatic relations. While the current US administration has sought to re-engage with traditional allies and to signal a return to a more predictable foreign policy, the residual effects of the preceding period continue to shape international dynamics. This has created a vacuum and an impetus for other major economic powers, such as China and Canada, to reinforce their own bilateral relationships and to explore avenues for greater economic resilience.

Canada, under Prime Minister Justin Trudeau, has consistently advocated for a rules-based international order and has sought to diversify its economic partnerships. While Canada maintains strong ties with the United States, the experience of recent years has undoubtedly highlighted the importance of nurturing robust relationships with other significant global economies. China, as Canada’s second-largest trading partner, represents a critical component of its economic future. Therefore, any initiative aimed at strengthening these ties, particularly in areas of mutual benefit, warrants close attention.

The implications of the Carney-Xi meeting extend beyond the immediate bilateral economic relationship. It signals a broader trend of nations seeking to de-risk their economies and to build resilience in the face of geopolitical volatility. In an era where global supply chains are increasingly scrutinized and the potential for economic coercion is a growing concern, countries are exploring strategies to diversify their markets, secure critical resources, and foster innovation. For Canada, this might involve exploring new avenues for trade and investment with China, while simultaneously ensuring that such engagements are conducted in a manner that upholds its national interests and values.

From an analytical perspective, the meeting can be viewed through several lenses. Firstly, it represents an attempt to manage the economic fallout from a period of significant global disruption. By engaging directly with a key economic power like China, Carney and his interlocutors are likely seeking to establish clear lines of communication and to identify areas where cooperation can mitigate potential risks. This could involve discussions on trade facilitation, investment screening, regulatory alignment, and the promotion of sustainable economic practices.

Secondly, the meeting underscores the evolving role of key economic actors in shaping the global financial architecture. As traditional hegemons recalibrate their foreign policy approaches, emerging powers and established middle powers are increasingly stepping in to fill perceived gaps and to advocate for new frameworks of cooperation. Carney’s participation, given his extensive background in central banking and financial regulation, suggests a focus on the deeper, structural aspects of the global economy. This could include discussions on financial stability, the role of international financial institutions, and the development of new mechanisms for cross-border investment and capital flows.

Thirdly, the dialogue highlights the complex interplay between economics and geopolitics. While the primary focus may be on economic matters, underlying geopolitical considerations are invariably present. The increasing assertiveness of China on the global stage, coupled with the ongoing recalibration of Western alliances, creates a dynamic environment where economic diplomacy plays a crucial role in shaping broader geopolitical outcomes. The meeting between Carney and Xi Jinping can therefore be interpreted as an effort to ensure that economic engagement serves to foster stability and to prevent further escalation of geopolitical tensions.

The potential areas of discussion between Carney and Xi Jinping are vast and multifaceted. Trade, a cornerstone of the Sino-Canadian economic relationship, would undoubtedly be a key topic. While bilateral trade has seen significant growth, there are also areas of friction and opportunity for further expansion. Discussions could revolve around increasing market access for Canadian goods and services, addressing trade imbalances, and exploring new sectors for collaboration. Investment, both inward and outward, would also be a critical agenda item. Canada has been a recipient of significant Chinese investment, and discussions could focus on ensuring that such investments are conducted in a transparent and mutually beneficial manner, while also exploring opportunities for Canadian investment in China.

Climate change and sustainable finance represent another significant area of potential cooperation. Both China and Canada have committed to ambitious climate targets, and there is a growing recognition of the need for international collaboration to address this global challenge. Discussions could focus on opportunities for joint investment in green technologies, the development of sustainable finance frameworks, and the role of financial institutions in mobilizing capital for climate action. This aligns with Carney’s previous work on sustainable finance and his known commitment to addressing climate-related risks in the financial system.

Furthermore, the dialogue could touch upon broader issues of global economic governance. As the international financial system evolves, there is a need for continuous dialogue and adaptation. Discussions could include the role of multilateral institutions, the reform of international financial regulations, and the development of new mechanisms for managing global economic risks. The experience of recent years has highlighted the importance of robust and adaptable international frameworks, and this meeting could serve as a platform for exploring ways to strengthen these existing structures or to develop new ones.

The presence of Mark Carney, a figure with a strong reputation in international finance, alongside President Xi Jinping, suggests a strategic approach to engaging China on issues of economic substance. It indicates a recognition that in an era of evolving global power dynamics, direct, high-level dialogue on economic and financial matters is essential for maintaining stability and fostering mutual prosperity. This engagement, while occurring within the broader context of global geopolitical shifts, underscores the enduring importance of economic diplomacy in navigating an increasingly complex and interconnected world. The outcome of such meetings will undoubtedly contribute to the ongoing redefinition of global economic relationships and the future trajectory of international cooperation.