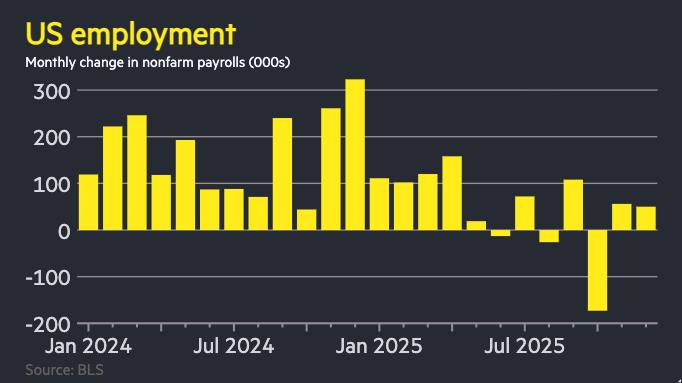

The United States labor market demonstrated a significant deceleration in its expansion during December, with only 50,000 new jobs added, a figure substantially below economists’ projections and indicative of a cooling economy.

The latest employment figures released by the Bureau of Labor Statistics have cast a shadow over the previously robust narrative of the American economy. The modest addition of 50,000 nonfarm payroll jobs in December, a stark contrast to the average monthly gains seen throughout the preceding year, has ignited concerns about the trajectory of economic growth. This significant miss against market expectations, which generally anticipated a figure closer to 150,000 to 200,000, suggests that underlying economic headwinds are beginning to exert a more pronounced influence. The implications of this slowdown are far-reaching, potentially impacting consumer spending, business investment, and the Federal Reserve’s monetary policy decisions in the coming months.

Analyzing the December Employment Report: A Deeper Dive

The December jobs report painted a picture of a labor market experiencing a noticeable cooling. The headline number of 50,000 jobs added significantly underperformed market consensus, signaling a potential shift in the economic landscape. This figure represents a sharp downturn from the revised gains of previous months, suggesting that the inflationary pressures and subsequent interest rate hikes by the Federal Reserve are beginning to dampen labor demand more acutely than anticipated.

Digging deeper into the sectoral breakdown reveals a more nuanced story. While some sectors continued to exhibit growth, albeit at a slower pace, others experienced contractions or stagnation. The leisure and hospitality sector, which had been a significant driver of job creation in the post-pandemic recovery, saw its pace of hiring moderate. Similarly, professional and business services, a bellwether for broader economic activity, also exhibited a deceleration. Conversely, the healthcare and social assistance sector continued to demonstrate resilience, reflecting ongoing demand for its services. The construction sector, often sensitive to interest rate movements, also showed signs of weakness, a trend that aligns with the broader impact of monetary tightening on interest-sensitive industries.

Underlying Factors Contributing to the Slowdown

Several interconnected factors are likely contributing to this deceleration in job growth. The cumulative effect of the Federal Reserve’s aggressive interest rate hiking campaign, aimed at taming persistent inflation, is a primary driver. Higher borrowing costs are making it more expensive for businesses to finance expansion, invest in new projects, and hire additional staff. This tightening of credit conditions is gradually filtering through the economy, leading to a more cautious approach from businesses regarding their labor needs.

Furthermore, the persistent high inflation experienced throughout the past year, while showing some signs of easing, has eroded consumer purchasing power. This reduction in disposable income can lead to decreased consumer spending, a crucial engine of the U.S. economy. As demand softens, businesses may find themselves with excess inventory or reduced sales, prompting them to reassess their hiring plans and potentially implement hiring freezes or even layoffs.

Global economic uncertainties also play a role. Geopolitical tensions, supply chain disruptions that, while improving, remain a concern, and the specter of recession in other major economies can dampen export demand and create a general sense of caution among domestic businesses. Companies with significant international operations may also be affected by slower global growth, which can translate into reduced investment and hiring domestically.

Expert Analysis and Interpretations

Economists are divided on the precise implications of the December jobs report. Some view it as a necessary and expected recalibration of an overheated labor market, arguing that a moderation in job growth is a sign that the Federal Reserve’s policies are working to bring the economy back into balance. They suggest that a slower pace of hiring, if accompanied by moderating wage growth, could help alleviate inflationary pressures without triggering a severe recession.

Others, however, express greater concern. They point to the significant miss against expectations as evidence that the economy may be more vulnerable to a downturn than previously understood. This perspective suggests that the cumulative impact of higher interest rates, coupled with ongoing inflationary pressures and global uncertainties, could lead to a more pronounced economic contraction. The risk of a "hard landing," where aggressive monetary tightening leads to a sharp economic downturn and significant job losses, is a central theme in this interpretation.

The composition of job gains is also a key area of analysis. A focus on the quality of jobs being created and the sectors experiencing growth versus contraction provides crucial insights into the underlying health of the labor market. For instance, a shift from higher-paying sectors to lower-paying ones, or a significant decline in manufacturing or construction jobs, could signal broader economic weakness.

Implications for Monetary Policy and the Federal Reserve

The December jobs report carries significant weight for the Federal Reserve as it calibrates its monetary policy. The central bank has been steadfast in its commitment to bringing inflation back to its 2 percent target, employing a series of interest rate hikes to achieve this goal. A weaker jobs report provides the Fed with more room to potentially slow the pace of future rate increases or even pause its tightening cycle.

However, the Fed will likely remain data-dependent, closely scrutinizing upcoming inflation figures and other economic indicators. If inflation remains stubbornly high, even with moderating job growth, the Fed may feel compelled to continue its tightening path, albeit cautiously. Conversely, if inflation shows a sustained downward trend and the labor market continues to cool, the Fed may signal a pivot towards a more accommodative stance, potentially preparing for interest rate cuts later in the year. The delicate balancing act for the Fed is to curb inflation without inducing a severe recession, and the latest employment data adds another layer of complexity to this challenge.

Future Outlook and Potential Scenarios

The outlook for the U.S. labor market in the coming months is uncertain, with several potential scenarios emerging from the current economic climate.

One scenario involves a continued, gradual deceleration of job growth. In this scenario, the labor market remains relatively resilient, with businesses adapting to slower demand by moderating hiring rather than resorting to widespread layoffs. Wage growth may also moderate, helping to alleviate inflationary pressures. This "soft landing" scenario would be viewed as a positive outcome, suggesting the Fed has successfully navigated the economic challenges without triggering a recession.

Another, more concerning, scenario is a sharper economic downturn. In this "hard landing" scenario, the cumulative impact of higher interest rates and persistent inflation leads to a significant contraction in economic activity. This could result in a substantial increase in unemployment, with businesses forced to implement widespread layoffs to cut costs. Such a scenario would pose significant challenges for policymakers and could lead to a prolonged period of economic weakness.

A third possibility is a period of stagflation, characterized by slow economic growth coupled with persistent inflation. While less likely, this scenario could emerge if supply-side constraints continue to fuel price pressures, even as demand weakens.

The coming months will be crucial in determining which of these scenarios is most likely to unfold. Key indicators to watch will include future inflation reports, consumer spending data, manufacturing indices, and the ongoing trajectory of interest rates. The resilience of the U.S. consumer, the ability of businesses to adapt to changing economic conditions, and the effectiveness of the Federal Reserve’s monetary policy will all play pivotal roles in shaping the economic landscape. The December jobs report serves as a stark reminder that the economic environment is dynamic and subject to significant shifts, underscoring the need for careful monitoring and analysis of evolving data.